GUIDING YOU THROUGH YOUR FINANCIAL JOURNEY

Am I Paying To Much in Taxes?

Most people think about taxes in April… after the bill is already set.

Real tax planning happens before year-end — not when you file. It’s about timing.

How a Retirement Income Specialist Transforms Scattered Accounts Into a Retirement Income Machine

Your retirement accounts are scattered everywhere, and you have no idea how they work together.

The Fine Print on Mega Backdoor Roth Conversions

Your 401k plan MUST allow after-tax contributions AND either in-service withdrawals or in-plan Roth conversions. Most plans don't offer both, check with your plan administrator first.

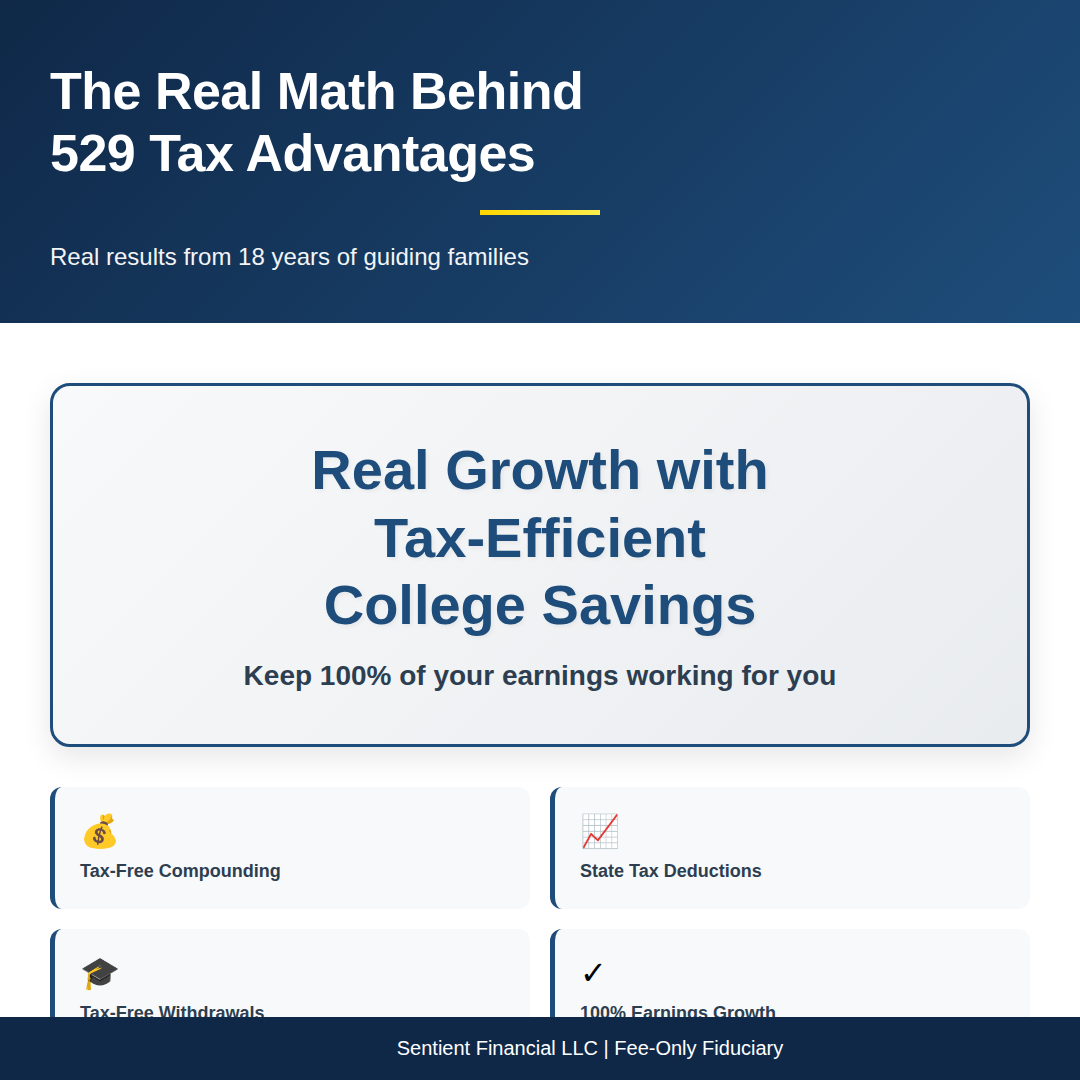

The Real Math Behind 529 College Savings Tax Advantage

Tax advantage growth of 529 College Savings Plans

How a Securities Backed Line of Credit Actually Works

A securities backed line of credit lets you access liquidity without selling investments or triggering capital gains taxes.

CHOOSING A FINANCIAL ADVISOR IN ORANGE COUNTY: A LOCAL’S GUIDE

Looking for a financial advisor in Orange County? Learn what makes a great local advisor and questions to ask before you commit.

3 Money Moves That Matter More Than Owning A Home

Homeownership is a great goal, but it's not the only or even necessarily the best path to building wealth. These three moves provide flexibility, growth potential, and security that can position you for long-term financial success.

Inheriting an IRA? Here's how to coordinate it with your retirement accounts

Coordinating Inherited IRA Withdrawals With Your Own Retirement Accounts.

3 Financial Problems Google Can’t Solve for You!

Google can't solve every financial problem for you.

Some situations require personalized expertise that goes beyond a search engine.

The $46,500 Roth Strategy Many High Earners Overlook

The Mega Backdoor Roth lets high earners contribute an extra $46,500 into tax-free retirement accounts.

The Hidden Downsides of Having Too Many Investment Accounts

Scattered retirement accounts can quietly slow your progress—time to get organized!

Having multiple 401(k)s, IRAs, or brokerage accounts across different firms might seem okay but it often leads to missed opportunities, duplicate holdings, and tax inefficiencies.

Why do successful people hire financial advisors? The answer might surprise you.

The most successful people understand that hiring experts isn't a luxury, it's a strategic advantage.

They delegate to specialists in areas outside their core competency and focus on what they do best.

Should You Pay Off Your Mortgage Early or Invest for Retirement?

Should you pay off your mortgage early or invest more for retirement instead?

Conventional wisdom says to eliminate debt as fast as possible, but the right answer depends on your interest rate, time horizon, tax situation, and the long-term growth potential of your retirement accounts.

3 Planning Moves to Make After You Max Out Your 401k

What should you do after you max out your 401(k)?

After you’ve hit the $23,500 401(k) limit for 2025, the next three levers are: after-tax contributions for a mega backdoor Roth, a taxable brokerage account for flexibility, and (if income is high) a backdoor Roth IRA.

Should Your 60/40 Portfolio Include Crypto? What New Research Shows

The classic 60/40 portfolio has served investors well for decades, but recent academic studies suggest that a small crypto allocation might actually enhance returns.

The Most Cringe Thing in Finance?

The Most Cringe Thing in Finance? 🤦♂️

It's maxing out every retirement account while living like you're already retired—driving a 15-year-old car, skipping every vacation because you're "saving for retirement."

Dividend Planning Reduces Stress in Rocky Markets

Patrick Thompson, AWMA discussing Dividend Income Planning and how it reduces stress in volatile markets.

The Costly Mistake of Letting Winners Run Too Long

It's easy to get caught up in the excitement when your investments are soaring—but letting winners run without a clear exit plan can lead to unexpected setbacks.